by Alex Ho

(Image source: storyset )

目錄

- Online Payment Ecosystem

- Issuing Bank

- ISO/MSP

- Payment Gateway

- Payment Processor

- Merchant Account

- Card Network

- How does VISA make money?

- Scan to pay

- Payment via NFC

- Apple Pay

- Apple Pay v.s. Google Pay

- Payment in e-commerce

- Top Players in the Market

- PayPal

- Adyen

- Consumer traits in different markets

- References

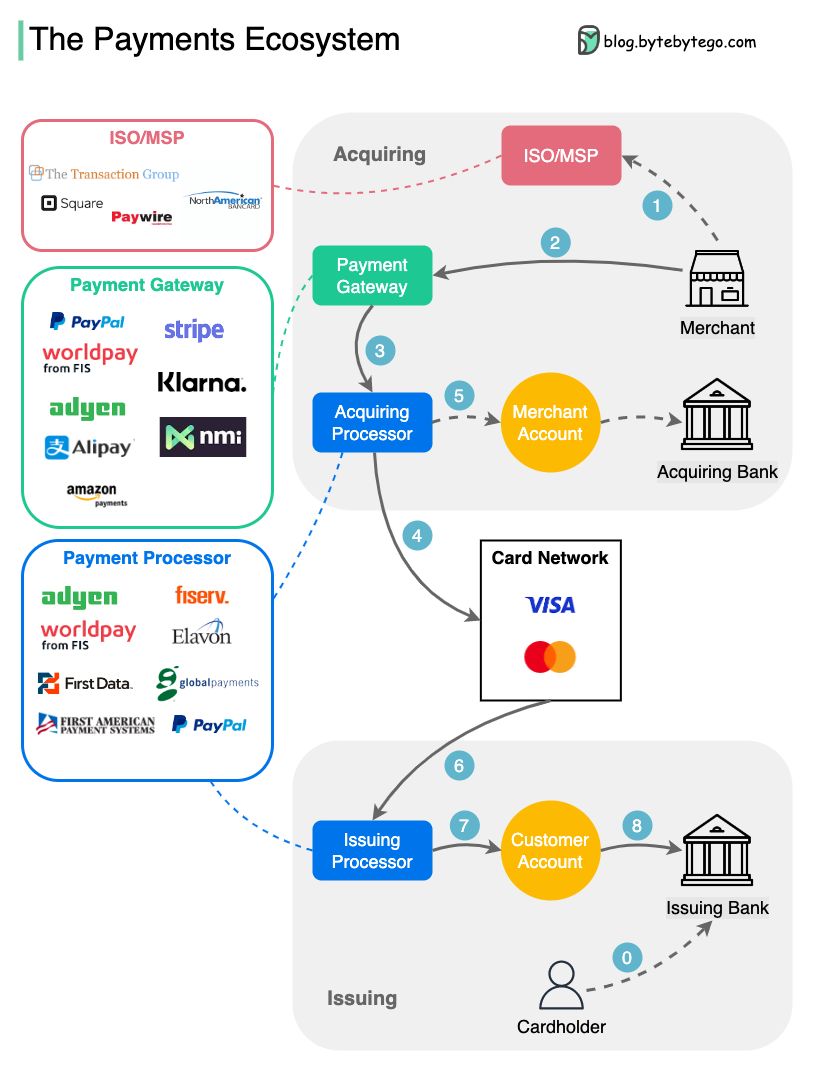

Online Payment Ecosystem

(Source: Hua Li )

Issuing Bank

Cardholderopens an account and apply for a credit/debit card at theissuing bank(發卡銀行)

ISO/MSP

- ISO = Independent Sales Organization

- MSP = Member Service Provider

- Merchant register in-store sales with ISO/MSP and opens a

merchant account

Payment Gateway

Payment Gatewaycan be seen as the online version of POS device which connects themerchant’s website/Appand thepayment processor- When cardholder (consumer) makes a

transactionat themerchant’s website/App, thePayment gatewayaccepts, collects, and then sends the payment information to apayment processor

Acquiring Bank (收單銀行)

Payment Processor

Payment Processor transmits the transaction information from consumer’s credit to the acquiring bank and the issuing bank. It’s like a middleman between the banks and the merchant.

Acquiring payment processor- Sending the transaction information (from merchant) to the

card network. - Operating the merchant account during settlement

Issuing payment processor- After the card verification is done by the

card network,payment processoruses customer information to collect the funds from theissuing bankto themerchant account

Merchant Account

Merchant accountunder theacquiring bank(收單銀行) is to accept online payment from the customers- The payment can later be automatically transferred to merchant’s own business bank account.

Card Network

- E.g. VISA, MasterCard

- Card Network verify if

- customer’s card has sufficient funds or credits for this purchase.

- the transaction is not a fraudulent behavior

- Card Network request authorization to the issuing bank to release the funds (for this purchase)

References

How does VISA make money?

(below content is from https://blog.bytebytego.com )

- The cardholder pays the merchant $100 to buy a product.

- The merchant benefits from the use of the credit card with more sales volume, and needs to compensate the issuer (發卡銀行) and the card network for providing the payment services.

- The acquiring bank (收單銀行) sets a fee with the merchant, called the

merchant discount fee. - - > 4. The acquiring bank keeps $0.25 as the

acquiring markup (acquirer’s revenue),and the rest of $1.75 is paid to the issuing bank as theinterchange fee. The merchant discount fee should cover the interchange fee.

The interchange fee is set by the card network

- because it is less efficient for each issuing bank to negotiate fees with each merchant.

- The card network (e.g. VISA) sets up the

network assessments and feeswith each bank. Each bank pays the card network for its services every month. - For example, VISA charges a 0.11% assessment plus a $0.0195 usage fee for every swipe.

- The cardholder pays the issuing bank for its services.

Issuer is compensated because

- The Issuer pays the merchant even if the cardholder fails to pay the issuer (Issuer covers the risks)

- The Issuer pays the merchant even before the cardholder pays the issuer

- The issuer has other operation coats

- managing customer accounts

- providing statements

- fraud detection

- risk managemnet

- clearing and settlement

Scan to pay

Payment via NFC

Apple Pay

(by Alex Xu)

Apple Pay v.s. Google Pay

Payment in e-commerce

Top Players in the Market

References

PayPal

Adyen

Consumer traits in different markets

USA

- Most of the consumers own bank accounts and credit cards

Europe

- Most of the consumers own bank accounts

- Credit card penetration rate in Europe is lower than in USA

Developing Markets (e.g. Southeast Asia, South America)

- Majority of people do not own neither bank accounts nor credit cards

- This is where digital wallet and BNPL (buy now pay later) have high potential

References

信用卡清償流程:

- 特約商店向收單銀行請撥持卡人刷卡消費之商品帳款收單

- 銀行於先行墊付特約商店帳款後,即透過信用卡組織清算網路向發卡銀行請撥代墊帳款

- 發卡銀行於撥付收單行代墊帳款,以月為單位結帳後,再發函通知持卡人繳納其於特約商店刷卡消費之帳款。

- 持卡人繳清消費總額或最低繳款金額後,刷卡消費之帳款即清償完畢。

About Alex

- Software Product Manager. Work experiences in Taipei, Singapore, and Shanghai.

- Currently based in Taipei City, Taiwan.

- Contact me via: alex.ho.helloworld@gmail.com