by Alex Ho

目錄

- Shopify Intro

- Shopify’s Business Model

- Subscription Solutions Revenue (訂閱解決方案 )

- Merchant Solutions Revenue (商家解決方案)

- Key Business Metrics

- Advantages of using Shopify

- Potential disadvantages of using Shopify (compared with using marketplaces)

- Shopify’s target customers

- Comparison with Competitors

- Layoff happened in July 2022

- Competition between Shopify and Amazon

- 2022 Shopify 零售產業展望白皮書 (The Future of Commerce in 2022)

- 財報重點

- 一些摘要數字

- 歷年財報數字

- 2020 年

- 2021 年

- 2022 年

- 世界局勢:

- 2022 Q1

- 2022 Q2

- 股價相關

- 未來展望與挑戰 (as of 2022 Q2)

- 產品摘要

- 各種 partnerships

- Shop App

- Shopify App Store

- POS App (Point of Sale)

- Shopify Audiences 廣告大聯盟

- SFN (Shopify Fulfillment Network)

- Tokengated Commence (NFT)

- Payment Gateway - 使用 Stripe

- 2021 推出的新功能

- 參考資料來源

Shopify Intro

Shopify’s Business Model

Subscrption Solutions Revenue : Merchant Solution Revenue = 28% : 72% (as of 2022 Q2)

(In 2014, the ratio was around 7:3)

Subscription Solutions Revenue (訂閱解決方案 )

- Merchants have to pay monthly subscription fees in order to use Shopify’s system

- Various subscription plans

- Basic:

- $29/month

- Merchant can use this “cheapest option” to start the business, but it will be expensive when adding on more features

- Shopify:

- $79 per month

- Majority of Shopify’s users are using this option

- Shopify Plus

- $299 per month

- Shopify Plus

- At least $2000 per month

- Aiming at corporate customers

- When Shopify acquires more merchants, they get more revenue from the Subscription Solutions

Merchant Solutions Revenue (商家解決方案)

- It means the commissions that Shopify charges from merchant’s transactions including following items:

Shopify Payments- A service that allows merchants to accepts credit cards payment (both online and offline)

- Merchant pays payment processing fees to Shopify

- Around two thirds of Shopify customers activated the Shopify Payment

- This accounts for majority portion in the Merchant Solutions Revenue

Transaction Fee- Commission based on the transaction order value.

- Commission rate

- Ranging from 0%-2%. (Amazon charges around 10%)

- Such commission rate is lower for customers who adopts the higher monthly subscription fee.

Shopify Capital- Shopify provides working capital for merchants.

- Shopify release loan to the merchants

Shopify POS (Hardware)- POS device at the store front

Shopify Fulfillment Network- Shopify provides several shopping partners for merchants to choose from.

Shopify Markets- Tools for merchants to manage the international sales

- https://help.shopify.com/zh-TW/manual/markets

Shop Pay Installments- If merchant have more transactions or higher transactions amount (order value), Shopify gets more revenue from the Merchant Solution Revenue

- Shopify’s interests are in line with the merchants.

Key Business Metrics

MRR (Monthly Recurring Revenue)- This reflects the revenue from the system subscription fee

GMV (Gross Merchandise Volume)- The order volume of products sold through Shopify platform by the merchants

- This reflects the scale of merchants’ business

Advantages of using Shopify

- Easy and simple to set up and use

- 24/7 customer support

- Developer ecosystems. Plenty of 3rd-party Apps built by developers for merchant to purchase in Shopify App Store

- Seamlessly integrations with many Apps or tools (e.g. Facebook, YouTube, Google…etc)

Potential disadvantages of using Shopify (compared with using marketplaces)

- Shopify is not a marketplace. Merchants have to drive traffic for their own online shops (mostly by purchasing online ads)

Shopify’s target customers

- Majority of Shopify’s customers are SMBs (small and medium-sized business)

- That is, Shopify has less enterprise customers.

Comparison with Competitors

Payment Process Fee Rate

Major competitors of Shopify

- Salesforce

- eComchain

- commercetools

Layoff happened in July 2022

- 原因:

- After the COVID-19 outbreak in early 2020, majority of retailers put much efforts to move customers from offline channels to online. Many retailers open online shops at Shopify.

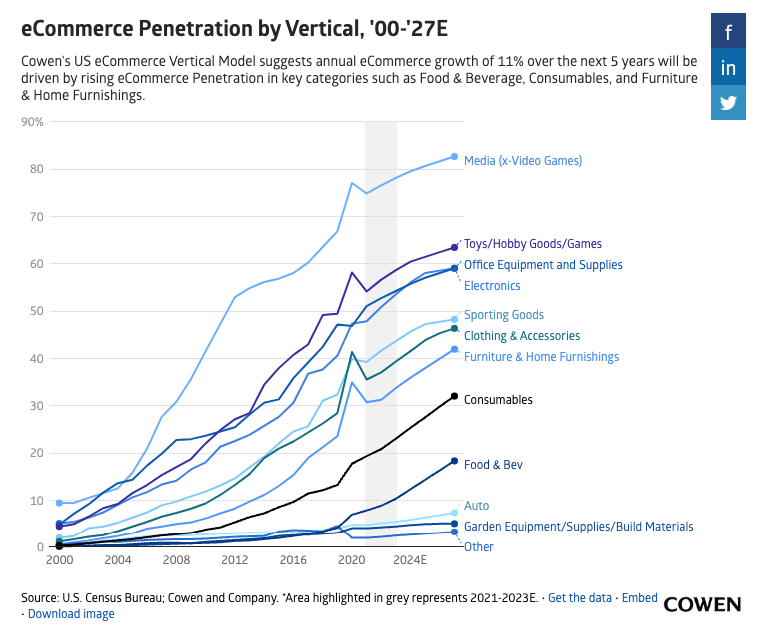

- Shopify CEO believed that 1) the online-to-offline ratio will remain after the COVID-19 pandemic is eased and 2) the pandemic accelerates the e-commerce penetration (over the overall retail market) by 5 to 10 years

- Shopify 決定把既有的 product roadmap 調整成 全力開發能幫助商店在線上銷售的功能

- 北美零售產業採用電商的滲透率佔比雖一度暴增至超過 15%,但隨著疫情趨緩卻回復到原本的成長曲線,電商成長不如 Shopify 原本的預期

- At the same time, Shopify needs to cut the iuncecessary expenses.

Competition between Shopify and Amazon

- Market share of USA e-commerce (as of 2020 Q3)

- Amazon: 37%

- Shopify: 6%

- eBay: 5%

- In 2021, Amazon launched a secret team to do research about Shopify’s business model.

- Some said Amazon was considering b3oa

- Amazon 可能是在考慮在 Amazon 生態系中建立一種新的電商模式,也許是讓 Amazon 的商家開啟 獨立站,也許是想辦法打擊 獨立站 開店平台 (e.g. Shopify)

2022 Shopify 零售產業展望白皮書 (The Future of Commerce in 2022)

財報重點

一些摘要數字

- 全球市占率:34.9% (as of 2021)

- 用戶數量:約 206 萬 (as of 2021)

- 毛利率:約 50%

- Payment Processing Fee

- Shopify 無法收取比競爭者更高的 費率,代表這產業已是高度競爭

- Take Rate

- 預計 Take Rate 難以被大幅提高,因為 payment processing fee 費率 沒有比競爭者更高

- 2022 開始變成虧損

歷年財報數字

Year | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

Users (mln) | 0.38 | 0.61 | 0.82 | 1 | 1.75 | 2.06 |

Growth % | 88.75% | 61.32% | 34.65% | 21.95% | 74.90% | 17.95% |

GMV per user | 40,795 | 43,186 | 50,122 | 61,100 | 68,382 | 85,022 |

Growth % | 6.93% | 5.86% | 16.06% | 21.90% | 11.92% | 24.33% |

GMV ($B) | 15.4 | 26.3 | 41.1 | 61.1 | 119.6 | 175.4 |

Growth % | 101.83% | 70.78% | 56.27% | 48.66% | 95.74% | 46.66% |

Take Rate (%) | 2.5% | 2.6% | 2.6% | 2.6% | 2.4% | 2.6% |

Growth % | -6% | 1.27% | 2% | -1.08% | -5.17% | 7.35% |

Revenue ($M) | 389.3 | 673.3 | 1,073 | 1,578 | 2,930 | 4,612 |

Growth % | 89.72% | 72.95% | 59.39% | 47.06% | 85.62% | 57.43% |

Khaveen Investments 預估未來數年的財務數字

2020 年

- COVID-19 疫情導致消費者大量使用電商買東西,墊高了電商公司的財務數字基期

- User 數量 暴增

- GMV per user 成長率 略低,但後來在 2021 又回升

- Shopify 開始投入大量資本開發基礎建設。例如 SFN

- 但 Shopify 不像 Amazon 一樣 有 AWS 作為 cash cow

2021 年

- 在防疫封鎖措施和政府刺激措施的推動下,電商繁榮蔓延到 2021 年上半年

- 通膨、缺工、塞港,導致 物流成本 與 大增

- 通膨

- User 數量 成長率 低於 GMV per user 成長率

- 2021 年底,美國等大國開始 緊縮通貨、準備調高 利率,導致 成長股公司、未獲利的電商公司 的 股價 或 公司估值 開始下跌

- 推測在 2022 全年的 營收成長率 數字不會太好

- Shopify 預計 2022 的資本支出會高達 2億美金。這可能讓投資人感到恐慌

2022 年

世界局勢:

- 通膨依然很嚴重,導致消費者支出降低

- 俄羅斯發動戰爭入侵烏克蘭

- 全球有許多國家的 COVID-19 疫情減緩。但因 2020、2021 的高基期,導致 Shopify 營收 年度成長率 下降

2022 Q1

- 營收 成長率 YOY +21.7%

2022 Q2

https://twitter.com/economyapp/status/1572580152990609408?s=46&t=If3XZOWfXN2Uyy9k1oTBMw

- (財報 link)

- GMV (Gross Merchandise Volume)

- 469億 美元,YOY + 11%

- GPV (Gross Payments Volume)

- 249億 美元,約為 GMV 的 53%

- 營收

- 12億美元

- 成長率 YOY +16%,遠低於 2015-2020 年區間

- 營收受到 美元升值 影響,大約影響 1.5% (currency headwinds from the stronger U.S. dollar)

- 訂閱解決方案 (Subscription Solution) 營收增加

- YOY +10%,因為 用戶 (商家) 數量增加

- $3.66 億美金

- 商家解決方案 (Merchant Solutions)

- YOY +18%

- $9.27 億美金

- 手上有 69.5 億美元現金 (cash, cash equivalents and marketable securities)

- 相較於 2021 Q2,有減少

- 虧損

- 淨虧損 12 億美元

- EPS: -0.95 美元 (每股虧損)

- Shopify 預期 2022 下半年會是虧損的

- 預期虧損規模:Q3 > Q4 > Q2

Total reported revenue growth year-over-year was negatively impacted by approximately 1.5 percentage points given the significant strengthening of the U.S. dollar relative to foreign currencies in the second quarter

股價相關

P/S Ration 一直在下降

未來展望與挑戰 (as of 2022 Q2)

- 外在環境導致消費者購物支出下滑 (無論是線上 or 線下購物)

- 全球大部分市場處於 升息循環

- 全球大部分市場 通膨率高

- 俄烏戰爭尚未落幕,許多國家飽受 能源缺乏 之苦

- 今年 Q4 的傳統購物季,恐怕不會有特別突出的 GMV 規模

- COVID-19 疫情對人類生活的影響逐漸減輕,電商線上購物 對 零售佔比 很可能會回到 pre-COVID 時代的水平

- Shopify 需要:

- 增加總體 用戶 數量

- 想辦法增加 enterprise 用戶 數量,因為 企業客戶續約率高、平均營收貢獻高

- 找出、並且做出 競爭者難以匹敵的產品及服務,提高 take rate

- 在各大平台隱私權政策影響廣告獲客成效的影響之下,需提出能 協助商家取得線上新客的流量 的解決方案

- 在疫情逐漸平息的 post-COVID 時代,順應消費者逐漸回到實體商店 (brick-and-mortar) 買東西趨勢,為商家提供線下消費場景的解決方案

- 收緊先前對於線上電商業務的過度樂觀看法,節省在先前作出相應決策導致的開支

- 試圖在 2023 上半年 結束虧損狀態

產品摘要

https://www.shopify.com/editions/summer2022/

各種 partnerships

- 可使用 Shop Pay 收款

- Facebook Shop

- Google Shopping 的 商家

- 讓商家 利用 product catalog 把商品 同步上架到 官網 (powered by Shopify) 以外 的其他平台,例如:Twitter Shopping、YouTube Shopping

- 可幫助商家 觸及更多 消費者 (increase the merchant reach)

- 可幫助提高 GMV per user

Shop App

- 若 消費者在 某 Shopify 的 商家買東西,消費者能在 Shop App 裡面查訂單 (order tracking)

- 能收集到 第一方數據 (對 Shopify 來說)

- 某商家使用 Shopify 系統開設網站,消費者在網站中累積的數據,是 商家的 第一方數據

Shopify App Store

- 吸引開發者在 Shopify 生態系中開發各種 App ,提供給 Shopify 的 商店客戶 使用

- 2021 Shopify 宣布 調整開發者的佣金比例

- https://help.shopify.com/zh-CN/partners/how-to-earn

- 賣 Shopify App 年收入 100萬美金以下者,佣金比例 調降為 0%

- 賣 Shopify App 年收入 100萬美金以下者,佣金比例 從 20% 調降為 15%

- 2020 年

- Shopify App Store 的開發者 收入 125 億美金

- Shopify 自己 收入 29 億美金

POS App (Point of Sale)

- A smartphone App that allows merchant to process sales in physical locations

- https://apps.apple.com/us/app/shopify-point-of-sale-pos/id686830644

Shopify Audiences 廣告大聯盟

- 背景

- 2021 之前的數年,在 Facebook 買廣告、導流到電商網站 一直是 no-brainer

- 自從 Apple 發動 ATT 隱私權政策

- 取得 第三方用戶數據 對 廣告平台 來說變得愈來愈困難。這會導致廣告成效變差

- 對廣告主 (e.g. 在 Shopify 上的商家) 來說,花錢投放廣告的效益愈來愈差,換句話說就是流量變貴

- 產品原理

- 參與這 program 的 商家需要 同意貢獻出 自己商店的數據,換句話說就是 不同商家互相分享自己的數據給別人,增加自己能利用的數據

- 商家可以以 單個商品 維度 去建立 對這商品有高度購買意圖的 受眾名單 (powered by Shopify’s machine learning)

- 建立名單之後,商家可把這名單傳送到 Facebook、Instagram 的廣告後台,建立相似受眾,對受眾 (名單中的會員) 去投放廣告

- 商家不能下載名單

- 商家不能看到名單中的消費者個資

- 目前 (as of 2022.05) 只有 美國、加拿大的 Shopify Plus 用戶 才能使用 Shopify Audiences 功能

參考資料

SFN (Shopify Fulfillment Network)

- 類似 Amazon FBA (Fulfilled by Amazon)

- 在美國可以 2 天到貨

- 商家可把商品送到 Shopify 倉庫,Shopify 幫廠商把商品寄送到 消費者手上

- Shopify 與 Flexport 合作、收購 Deliverr 物流公司

Tokengated Commence (NFT)

Tokengated commerce, enabling merchants to deepen connections with new fans and VIPs by giving NFT holders exclusive access to products, perks, and experiences across online, mobile, and offline surfaces

Payment Gateway - 使用 Stripe

- 所以 Shopify 需要付很多錢給 Stripe

2021 推出的新功能

- Hydrogen-Oxygen for headless

- Online store 2.0

- Shopify Market

- Shop Pay

- Shopify NFT beta

- Social Commerce integration - TT, FB, Google, etc.

參考資料來源

產業專家 Clement Tang 散見於網路上的見解,對本文亦有貢獻

About Alex

- Software Product Manager. Work experiences in Taipei, Singapore, and Shanghai.

- Currently based in Taipei City, Taiwan.

- Contact me via: alex.ho.helloworld@gmail.com

![[2022] Shopify評價:收費版介紹+優缺點分析](https://images.spr.so/cdn-cgi/imagedelivery/j42No7y-dcokJuNgXeA0ig/3acf9014-3c62-47a5-8130-63233e6a7ed4/online-shopping-1/w=640,quality=90,fit=scale-down)